It is important to know all about shipping duties and taxes when shipping internationally. Here is a detailed guide on understanding shipping duties and taxes.

What are Shipping Duties and Taxes?

Duties and Taxes are tariffs that are imposed on goods when they are shipped internationally across borders. The main intention of charging custom shipping duties and taxes on goods that are imported from other countries is to protect the country’s environment, residents, economy and jobs, etc. It is done by controlling the flow of goods and also by restricting the prohibited goods’ flow in and out of the country.

Duty is estimated upon various factors like where you obtained the items, the place of manufacture, what it is made of, etc. Each country determines the amount for duties and taxes differently.

Let’s see more in detail.

What are Duties and Taxes based on?

Several factors determine the duties and taxes that are imposed on shipments, they are:

- Using HS Code to classify the type of product. The customs authority uses this code to identify what is being shipped and also to apply relevant taxes, duties and other regulations if needed. Learn more about harmonized tariff codes

- The value of the goods, which includes the insurance fees and freight charges, also helps the customs to determine the duties and taxes and also to clear the shipment from customs. Hence it is important to state the right value in the commercial invoice.

- The description of goods on the commercial invoice is yet another important factor, which includes the product’s end-use and country of manufacture. Also, remember that the HS code and the description of the goods should match to ensure that the goods are classified correctly.

- The International trade agreements between the countries do impact the duties and taxes imposed on the shipment. For example, the shipment might go through the customs at a reduced rate or they might be exempt from taxes and duties in case there is an international trade agreement between those nations.

- Remember to be clear and specific about Incoterms on the commercial invoice, which defines the agreement between the receiver and the sender in terms of who pays the taxes, duties and shipping costs.

Why do custom duties matter in international shipping?

When you are shipping to other countries, you and your customers will be asked to pay some additional duties and taxes before the shipment arrives at the destination. Most governments tax any kind of shipments from other countries for few reasons like:

- To help protect domestic companies from foreign competitors.

- Increase the revenue through taxes.

- Control or restrict the flow of certain goods into the country.

It is important to know more about taxes and duties when you are shipping internationally.

Duties and Taxes Basics

Firstly, let us explore the basic terms that come across in taxes and duties and what they mean.

Import Duty: It is the tax imposed by the local government on goods that are from other countries. Most often the import duty is high on goods that are less desirable by people as they are encouraged to support the local market than foreign ones. You can see that the import duty varies upon the category of goods, whereas the GST and VAT remain almost the same.

GST: Goods and Services Tax, or GST, is charged in various stages and it is reimbursed at the end for others except for the end buyer. The GST values are different from VAT as it’s a flat-rate percentage value of a total transaction and not the percentage of a value-added.

VAT: VAT or the Value-added Tax is charged to consumers when they purchase any goods or service.

Commercial Invoice: This is an important document when it comes to shipping. It contains the values of the items in the shipments. This document is referred for clearing and processing the package through customs.

De minimis Value: This is the tax threshold, which is the amount where a person begins to pay the taxes for an item.

What are Incoterms?

Incoterms is the term from the phrase “International Commercial Terms” and is set for every ten years by the International Chamber of Commerce (ICC). The current edition contains rules from 2010. These usually contain the terms describing whether the sender or the receiver will be paying the duties and taxes.

Here are some things that make them quite beneficial for all:

- Has a set of rules, which are quite straightforward about the responsibilities for each party.

- Quite Standardized.

- Accepted worldwide.

DDU vs DDP

DDU and DDP come into the picture for B2C companies and other traditional eCommerce sellers who are shipping small parcels.

DDP or Delivery Duty Paid Incoterms are where the seller is responsible for handling any risks and costs for the shipment. It includes import duties and other delivery charges too.

DDU incoterms or Delivery Duty Unpaid is where the receiver or the customer is responsible for paying and settling the charges in the order for getting the item released from the customs.

Learn more about DDU Vs DDP.

How to Calculate Customs Tax

Now let’s get to know how to calculate the taxes.

Valuation Methods

To calculate the import tax and the import duty amount for your shipment, all you need to do is multiply the shipment’s taxable value with your destination country’s tax duty percentage. Also, remember that the import duty percentage is varied for each category of goods. Moreover, the taxable value varies with countries. Two major valuation methods are used to determine the taxable value by several countries:

FOB: “Free On Board” or FOB is the value of the product, which is considered to be the taxable value. If you are shipping via sea freight then the charges will include both loading and transportation. If the shipment arrives by air freight then the transportation cost is not included.

CIF: “Cost, Insurance, and Freight” or CIF is the taxable value that includes the item value, cost of insurance if applicable and transportation to the final destination.

Taxable Value includes |

FOB |

CIF |

| Item Value | Taxable | Taxable |

| Insurance | Taxable | |

| Transportation | Taxable |

Who pays for import duty?

Finding out who pays the import duty is important to avoid any kind of surprises in the end. If you are sending the parcel with DDP, then let’s see how certain shipping couriers handle the same.

USPS: Customs Charges Unavailable

In the case of shipping with USPS, they do not provide DDP. The postage charge covers the cost of transporting and then delivering your parcels. And if you are planning to ship your item for dutiable international shipment, then your customer will be the one who has to pay the duties and taxes incurred and also need to work with the customs if any amount is owed.

DHL Express CustomsAsies Process

DHL Express has a standard courier handling fee, which is about $15USD to process payments for DDP.

FedEx Customs Duties Payment

FedEx has a standard courier handling fee of about $10USD to process payments for DDP.

UPS Custom Tax

UPS has a standard courier handling fee which is about $15USD to process payments for DDP.

How to Plan for Duties and Taxes

It is important to know all about duties and taxes before you start shipping to ensure you have a better and smooth shipping experience.

What is the customs duty and import tax amount for your shipment?

Tax threshold varies with country. The tax threshold is the amount where a person begins to pay taxes on an item. It should be noted that the customs duty does not apply to all international shipments.

A shipment’s duty and the tax amount is based on the following:

- Product value

- Trade agreements

- Country of manufacture

- Description and end-use of the product

- The product’s Harmonized System (HS) code

- Country-specific regulations

For example, the duty percentage, or trade tariff, rate on a woman’s T-shirt that is imported from the US to the UK is 12%.

If you want to add the HS code for your shipment, then you can make use of the ELEX WooCommerce DHL Shipping Plugin and then you can choose a special service depending on the item you are shipping in the plugin settings.

Also, remember to choose the respective UN number too.

In the individual product settings, you can also choose the recommended HS tariff code.

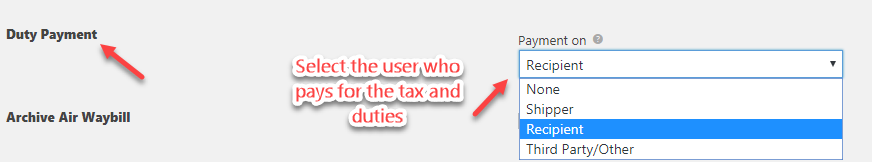

By setting these options, you can easily generate customs compliant documents error-free. Moreover, the plugin also lets you set who will be paying the custom duty charges for the shipment.

Streamlining small processes can indeed help you to organize your shipping effectively.

Get to know more about the ELEX WooCommerce DHL Shipping Plugin.

When do I need to pay the duties and taxes on a shipment?

It is important to pay the duties and taxes for your shipment. And it must be done before the goods are released from customs to the destination address in the country. Sometimes your carrier might be able to pay the charges on your behalf to get the shipments free from customs. There are several things you need to keep in mind to avoid the shipment being stuck at the customs. Luckily several ways will help to make the customs and duties a hassle-free process.

Other costs to keep in mind

To know about the actual charges it is important to have complete knowledge of shipments landed costs or totals costs. Other charges that come into the picture are:

Carrier charges: It covers the charges that are incurred for shipping the package from the origin to the destination. Some carriers also include the charges along with the carrier cost so that duties, taxes etc., are charged together.

Surcharges and ancillary fees: These charges apply when you are shipping items that are falling under special categories like dangerous goods, prohibited ones and temporary imports, etc.

Broker Fees: The broker fee is the charge that is incurred by using a customs broker to help clear goods from the customs. They often pay the duties and taxes on behalf of the customer.

Insurance: It is important to ensure your goods are insured while they are being shipped to the recipient to protect yourself from any damages caused by unforeseen incidents or loss or damage during the transit.

Does your business need a customs broker?

A customs broker works as a middle man to ensure shipments will easily clear customs at both the country of origin and the destination country. They are quite good with the customs duties, rules, and regulations of countries.

You need to choose whether you need a customs broker depending on the type of business you do. Most businesses that send their shipments to customers internationally do not need a customs broker.

What is the best way to communicate duties and taxes paid to customers?

In the case of businesses that are selling worldwide, they can encounter a high “cost to serve” from international customers if they are not clearly defining duties and taxes.

Not being clear in terms of how much to be paid and who is paying when shipping, you are truly running into trouble like:

- Wasting a lot of time on queries from customers.

- Getting cancelled orders because customers decline to pay any customs charges.

- Upset customers who were caught unprepared with unforeseen fees.

It is always ideal to be upfront with your customers when it comes to duties and taxes to be paid. Also, keep them informed if they need to pay for these. To simplify the process, you can mention that the customers are paying the duties and taxes on their shipments in the following places:

- In the Checkout Page on your store.

- Product pages.

- Your shipping policy page.

- Order Confirmation emails.

What are the common documents required for your package when you are shipping internationally?

Incomplete documents for your package is one important factor that might cause the package to be stuck at the customs. Hence it is important to attach the necessary documents for your shipment. The necessary documents vary from country to country and also for different products.

The important transportation documents include:

Airway Bill – Any shipments shipped via Air Freight require airway bills. The airway bill can be obtained from your shipper. If you are using their online APIs, you can easily archive air waybills with ease right from your shipping plugin.

Bill of Lading – This is an agreement between the shipper or the owner and the shipping carrier of the shipment. It should include the details like the Content description, Address of shipper and recipient, etc.

Electronic Export Information Filing (formerly known as the Shipper’s Export Declaration) – This form needs to be filled online, if the package is valued at more than $2,500 and if the product requires any export certificate for shipping.

Destination Control Statement – It is a legal statement for exports from the US for products listed in the Commerce Control List that are outside of EAR99 (Export Administration Regulations) or controlled under the International Traffic in Arms Regulations (ITAR). The Destination Control Statement must be printed on the commercial invoice, airway bill or on the ocean bill of lading, that the item can be exported to certain countries only.

Generic Certificate of Origin – This contains all the information of the manufacturer and is certified by a government body or the chamber of commerce.

The rest of the certificates include export certificate, halal certificate, dangerous goods and radiation certificate, insurance papers and dock certificate.

You can check for an updated list of products that are in the prohibited and restricted lists in all countries around the world on the page Export.gov.

How can you print and obtain customs compliant documents for your shipments?

You need to ensure that you are sending your packages across locations, with the right documents along. To print the customs compliant document right from your WooCommerce dashboard you can make use of ELEX WooCommerce DHL Shipping Plugin. The plugin lets enter all the requisite information to get the customs clearance documents in the initial set up. Always remember to enter proper addresses while shipping, as an incorrect address, can make it impossible for a delivery. So it is good to use address validation.

Also in the plugin, you get a commercial invoice printed for each package, which is important for international deliveries. So if you enter the requisite amount of information, then you get the invoice printed correctly.

What happens in the Customs? The Customs Clearance Process

Let’s get to know what exactly your shipment undergoes when it arrives at the customs and how the duties and taxes are affecting the customs clearance process.

Here is a brief understanding of what happens to your shipment when it arrives at customs.

- The very first thing that the customs officer will be looking into when your shipment arrives at the customs is the package and the paperwork. Remember to attach a commercial invoice for all the international shipments. Also, if the shipment has certain restricted or prohibited items, then it needs to contain the additional documents for the same.

- Now the customs officer takes a look at the value and category of your item on your commercial invoice. They might also cross-check the prices and the category of the items on your website to know whether the price mentioned on the commercial invoice and the website are the same or not. Hence it is ideal, to be honest when you are doing your paperwork. This will decide the duties and taxes you need to pay for your shipment.

Now if the value is above the de minimis threshold value then duties and taxes apply for the shipment. - Next, they will check who will take care of the taxes and duties payment (the sender or the recipient). If the item arrived with the duties paid, then the item is released for delivery, because the sender already paid the duties. However, if the duties aren’t paid, then the recipient has to handle it. In such cases, customs will hold the package and the recipient is contacted by the independent broker who is appointed by the seller to get the payment done to release the shipment.

- Once all the taxes and duties payments are cleared and approved, the item is out for delivery.

How to Ship Internationally with Essential Documents from your WooCommerce store?

If you are shipping internationally, then you need to be sure about certain documents you are providing while shipping. Then the next important step is to choose the right shipping carrier for shipping.USPS. Stamps.com, DHL, etc., are a few of the prominent options for shipping internationally. For example, when you are shipping from the UK to the US locations, then you can make use of the EasyPost shipping options wherein you can get UPS, FedEx and USPS services.

As shown in the above image, you can see a list of international shipping services listed for shipping from the UK to the US. To integrate shipping carriers to your WooCommerce store, you can make use of several shipping plugins like:

- ELEX WooCommerce DHL Express / eCommerce / Paket Shipping Plugin with Print Label

- ELEX WooCommerce USPS Shipping Plugin with Shipment Tracking & Print Label

- ELEX Stamps.com Shipping Plugin with USPS Postage for WooCommerce

- ELEX EasyPost (FedEx, UPS, Canada Post & USPS) Shipping & Label Printing Plugin for WooCommerce

How to include Tax information on your WooCommerce store?

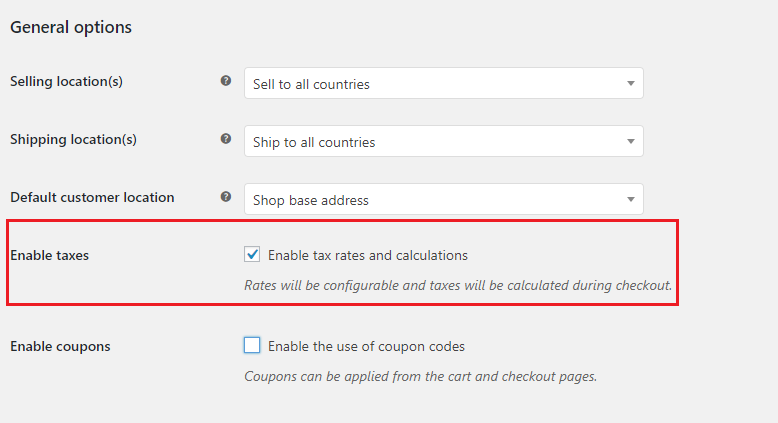

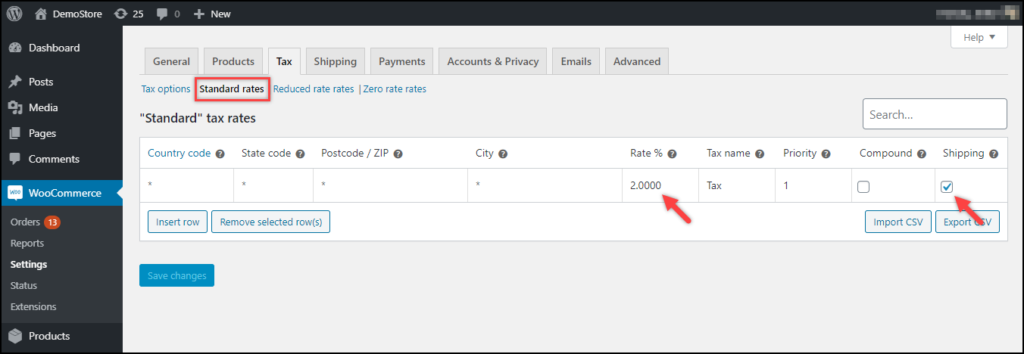

When you are running a WooCommerce store, you can easily include the tax specific information on your WooCommerce Tax section by enabling the WooCommerce Tax in WooCommerce.

Once the Tax is enabled, you can enter requisite data in the fields concerning the country you are shipping from and to. You can also enter user-defined data to charge the taxes as per your shipping rules.

Learn more about WooCommerce Tax settings.

Never Avoid Paying Duties And Taxes

It is important to know that not paying the tax is indeed tax evasion. Not paying your taxes can cause your business to get fined, and hence it is important to be regular and upfront with the customers and customs in terms of paying taxes.

Further Reading:

- Top 8 Best International Shipping Companies in the World

- An Ultimate Guide on USPS Domestic & USPS International Shipping Rates

- Enable WooCommerce International Shipping Rates and Generate International Shipment Labels by Integrating ELEX Shipping Plugins

- International Shipping FAQs Answered

- Beginner’s Guide to International WooCommerce Shipping