So you’ve built an amazing eCommerce store and you’re ready to start selling your products online. Now comes one of the most important business decisions you’ll make: choosing a payment gateway. The payment gateway you select can make or break your business.

It’s not just about processing customer payments, it’s about providing a seamless buying experience, keeping costs low, and maximizing your profits. With so many different types and options out there, how do you know which one is right for your business?

In this article, we’ll walk through the different types of payment gateways, explore their features, and help you determine the best solution based on your business needs. By the end, you’ll have the confidence to choose a payment gateway that will scale with your growing business. Let’s dive in!

What are Payment Gateways and How do they Work?

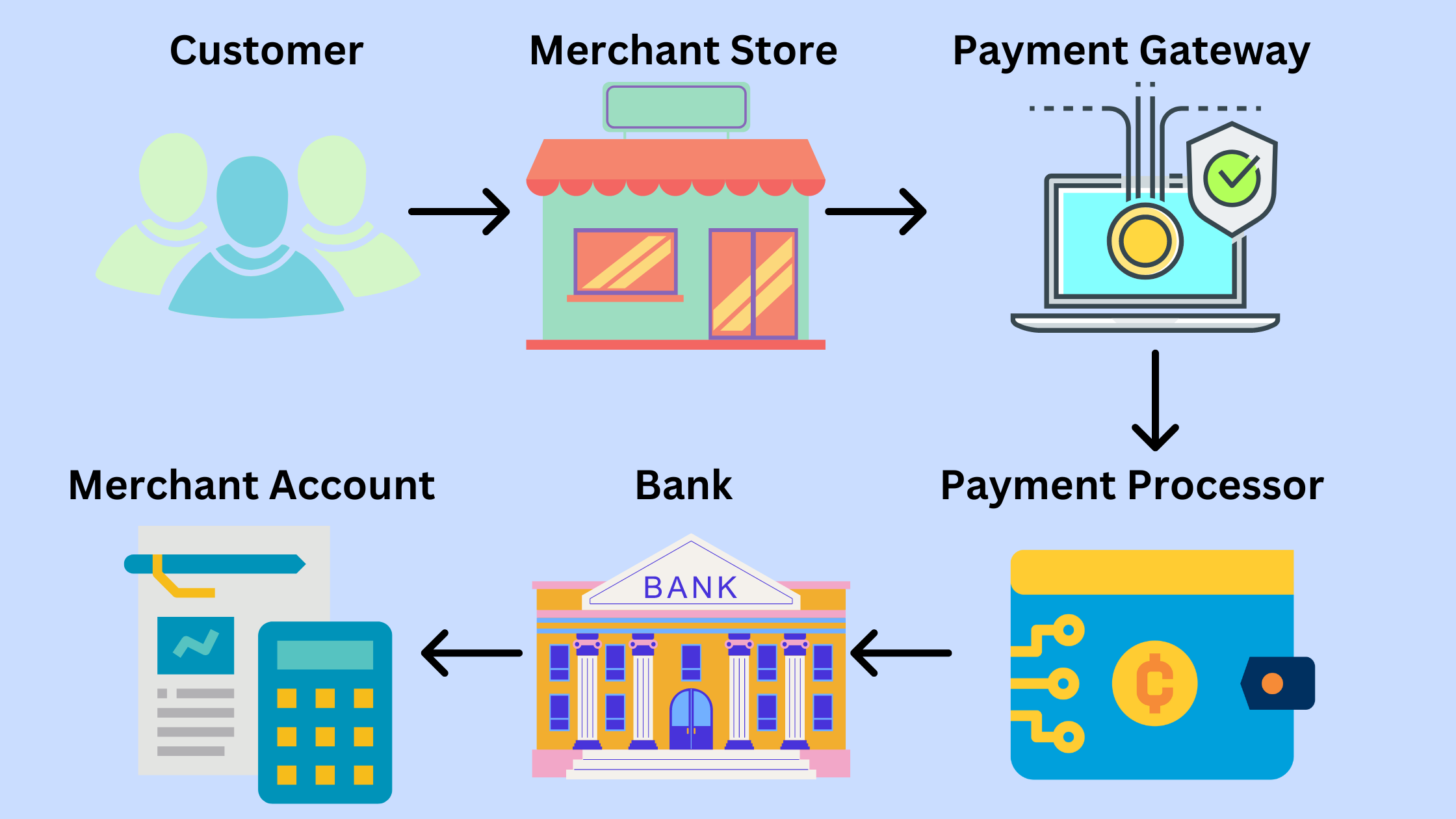

So what exactly are payment gateways and how do they work? For online retailers and other businesses, payment gateways are services that approve and process credit/debit card payments. They act as a middleman between your website and your customer’s credit card issuer.

When a customer enters their card info to make a purchase on your site, the payment gateway encrypts and sends that sensitive data to the appropriate card network (Visa, Mastercard, Amex, etc.) for approval. If approved, the transaction will be completed, the customer is charged, and the funds are deposited in your account, minus any fees.

With so many options like Stripe, Braintree, Authorize.net, PayPal, and more to choose from, selecting a payment gateway is an important decision that can be tricky. Do some research on the pros and cons of different gateways to find one that meets your business needs and budget. A good payment gateway will allow your eCommerce business to run more efficiently while keeping your customers’ data safe and secure.

Benefits of Implementing Payment Gateways in Your eCommerce Store

Implementing a payment gateway on your eCommerce store comes with some serious perks.

For starters, it makes the checkout process super simple for your customers. They can pay quickly and securely without having to leave your site. Talk about convenience! Offering multiple payment options also means more completed sales since customers can pay with their preferred method.

Another big benefit is fraud prevention. Reputable payment gateways use anti-fraud tools to detect suspicious activity and block fraudulent transactions. This helps ensure you actually get paid for the products you ship out.

Payment gateways also handle the transfer of funds between the customer, the merchant account, and your business bank account. They facilitate the entire payment process so you don’t have to deal with the technical aspects. You just have to worry about making sales!

With a payment gateway powering your store, you’ll gain valuable insights into your customers and sales. Things like transaction histories, payment trends, best-selling products, and more. These kinds of analytics help you make better business decisions to boost your bottom line.

If streamlining your checkout, reducing fraud, simplifying payments, and gaining actionable insights sound good to you, it may be time to implement a payment gateway. Find an option that fits your needs and budget to start reaping the rewards. Your customers and your business will appreciate it!

Credit Card Payment Gateways: Fast, Secure, and Reliable

Credit card payment gateways are popular options for eCommerce businesses. They’re fast, secure, and reliable. Additionally, credit cards are gaining popularity among users and are a preferred mode of payment nowadays.

Easy To Use

Credit card gateways are simple to set up on your website. They provide you with a code to paste into your checkout page that securely collects your customer’s credit card details and processes the payment. Popular options like Stripe, Braintree, and PayPal are easy to integrate with most eCommerce platforms and shopping carts.

Fast And Secure

Once implemented, credit card gateways handle the entire payment process for you. Your customers enter their card number, expiration date, and CVV code on your site, then the gateway verifies the details, charges the card, and deposits funds directly into your merchant account. Credit card payments also offer strong fraud protection and PCI compliance to keep your customer’s data secure.

Low Maintenance

For small businesses, credit card gateways are affordable, with most charging a percentage fee per transaction. They’re a simple, low-maintenance solution to accept payments online. Whether you need basic credit card processing or more advanced features like recurring billing, you’ll find a gateway to suit your needs.

In summary, if you’re looking for a proven, newbie-friendly way to accept payments on your eCommerce site, a credit card gateway is a great option to consider. They make the technical side of processing secure credit card transactions easy so you can focus on growing your business.

Debit Card Payment Gateways: Convenient for Customers

Debit card payment gateways allow customers to pay directly from their bank account. Many shoppers prefer this convenient method since the money is immediately deducted from their account and the fact that almost everyone uses debit cards.

Lower Fees

Debit card transactions typically have lower processing fees for merchants compared to credit cards. The fees are a flat rate per transaction instead of a percentage of the total purchase amount. This can save merchants a good amount of money, especially on large ticket items.

Faster Settlement

Funds from debit card payments are deposited into the merchant’s account within 1 to 2 business days. This is faster than most other payment methods. The quick settlement time allows businesses to have access to capital sooner.

Fewer Chargebacks

Chargebacks occur when customers dispute a charge and request a refund. Debit cards have a lower chargeback rate since the money is deducted directly from the customer’s bank account. This results in fewer disputed transactions and less money lost for the business.

Security

Debit card payments utilize encryption and other security measures to protect customer’\s’ financial information. This helps prevent fraud and ensures that funds are deducted only with the cardholder’s consent. Robust security is essential for any payment gateway and gives shoppers confidence in the transaction.

In summary, debit card payment gateways provide an easy way for customers to pay while also benefiting merchants with lower fees, faster funding, fewer chargebacks, and strong security. For most businesses, debit cards are an ideal payment method to offer customers.

eWallet Payment Gateways: Ideal for a Digital Era

eWallet payment gateways have a number of advantages, including cost savings, ease, security, and quickness. They are an appealing choice in the age of technology because of these features for both businesses and consumers.

Easy To Use

Payments may be made easily with eWallets. In order to avoid having to enter payment information for each purchase, users can securely keep their payment information in the eWallet app or website. This saves time and effort, particularly for people who frequently purchase online.

Secure And Reliable

eWallets secure user data and financial information using cutting-edge security methods. Sensitive data is safely delivered and stored according to tokenization and encryption methods. eWallets further decrease the chance of card fraud and illegal transactions, as users are not required to give businesses their card information.

Faster Transactions

eWallets make transactions simple and quick. Users don’t have to enter long card information or wait for payment processing; instead, payments may be made with only a few clicks or taps. This may be especially useful for companies that wish to provide customers with a simple checkout process and lower cart abandonment rates.

Global Access

Since eWallets are accessible and usable from anywhere in the world, companies may increase the size of their consumer base. Users may pay in a variety of currencies, which facilitates cross-border transactions.

Rewards

Some eWallets provide users with cashback incentives, prizes, or loyalty schemes. This promotes consumer loyalty and repeat business. These programs may be used by businesses to draw in and keep clients.

Integration

eWallet payment gateways can be connected with a variety of platforms, including point-of-sale (POS) systems, mobile apps, and e-commerce websites. Due to this adaptability, it is simpler for businesses to take payments via various channels and devices.

eWallet payment gateways provide a convenient option for customers and can help boost your conversion rates. Be sure to evaluate fees, features, and your target customer base when choosing a provider. Multiple gateways may also be an option to give shoppers more choices.

Bank Transfer Payment Gateways: Slow but Still Useful

Customers can pay merchants or service providers directly from their bank accounts via bank transfer payment gateways, sometimes referred to as direct bank transfers or online bank transfers.

Slow But Reliable

Bank transfer payment gateways may not be the flashiest option, but they get the job done. With this method, customers pay directly from their bank account. The funds are transferred securely to your merchant account, typically taking 3 to 5 business days to process.

Avoid Fee

While not ideal for instant gratification, bank transfers offer reliability and security. Many customers appreciate the familiarity of paying directly through their bank. You also avoid paying credit card processing fees, since the transaction happens outside of card networks.

B2B

The downside is that transfers can take days to clear, delaying order fulfillment. They also require customers to manually input their banking details, which some may find tedious. However, for high-ticket or business-to-business items where speed is less important, bank transfers remain a useful payment method.

For eCommerce businesses on a budget, bank transfer gateways offer an affordable way to accept payments without sacrificing security. While the technology may be simple, it provides a reliable and stable solution for those willing to wait a few extra days for funds to clear.

International Payment Gateways: Expand Your Reach Globally

As your business grows, you’ll likely want to start selling to customers internationally. To do this, you’ll need a payment gateway that supports global payments and currencies. Options like Stripe, PayPal, and Braintree all provide seamless international payment processing.

Expand Into New Markets

By utilizing an international payment gateway, you open up a world of possibilities. Most global/international payment gateways allow you to accept payments in over 135 different currencies, making it easier than ever to expand your customer base globally.

Locally Reliable

Offer localized payment methods, such as Alipay, Google Pay, Apple Pay, Direct Debit, and more, ensuring that your customers have convenient and familiar ways to pay.

Security

Protect yourself against fraud with features like 3D Secure and address verification, giving you peace of mind and keeping your transactions secure.

Streamlined Process

Streamline your financial processes by using a single platform for all payments, whether they are domestic or international. This makes reporting and reconciliation a breeze, saving you time and effort.

An international payment gateway opens you up to new customers across the world. And with global eCommerce sales rising, you’ll want to make sure your store is ready to capitalize on new opportunities for international growth.

Now that we have gone through the more mainstream types of payment gateways, let us look at a few lesser-known yet reliable payment gateways.

Alternative Payment Gateways: Accepting Crypto, Wire Transfers, and More

Cryptocurrency Payments

Accepting cryptocurrency like Bitcoin or Ethereum opens you up to a new pool of customers. Crypto payments are ideal for businesses selling digital goods or services. Set up a digital wallet to accept crypto payments on your site. Make sure you understand the volatility of the currencies before accepting them.

Wire Transfers

For high-ticket or business-to-business sales, wire transfers are a convenient option. Wire transfers move money electronically from one bank account to another. Buyers will need your banking details to send the payment. While convenient for large payments, wire transfers typically have higher fees for both buyers and sellers compared to other methods. They also take longer to process, usually 1-2 business days.

Keep in mind, a wire transfer is slightly different from direct bank transfers as they use a SWIFT network to transfer money and are generally used for larger sums of money.

Payment Plans

If you sell higher-priced goods or services, offering payment plans or installment payments lets customers pay over time with interest. Use a third-party payment plan service to set up the terms, collect payments, and deduct any fees automatically each month. This makes the payment process easy for both you and your customers. Payment plans do come with some risk of non-payment, so choose your partners and customers carefully.

An important point to note is that even though these are different types of payment gateways, most gateway providers like Stripe, Authorize.net, PayPal, and more offer a culmination of these various payment gateways under a single platform.

If you wish to understand the features of the various payment gateway platforms out there, check out 11 Best Payment Gateways In The USA for businesses in the USA, 10 Best Payment Gateways In the UK for businesses in the UK, and 8 Best Payment Gateways In India For Recurring Payments for businesses in India.

Conclusion

So there you have it—the major eCommerce payment gateways and how they stack up. At the end of the day, you need to go with what makes the most sense for your business and customers.

The payment gateway you choose can have a huge impact on your business’s success. Do some research, read reviews from other merchants in your industry, and take advantage of any free trials to test out your options. An easy, seamless checkout process is key to keeping customers happy and coming back. Choose wisely and your eCommerce business will be well on its way to becoming successful!

We hope this post has helped you understand the different types of payment gateways out there!