So you’ve built an amazing online business in the UK, and now you need a way to accept payments from your customers. Choosing a payment gateway is one of the most important decisions you’ll make as an eCommerce business owner. The payment gateway you select will impact your customer experience, fees, and security. With so many options out there, how do you decide which one is right for your business?

We evaluated a bunch of top payment gateways in the UK based on fees, features, security, and customer service. In this article, we’ll share the top 10 payment gateways in the UK so you can choose the best one for your requirements. Let’s dive in!

PayPal: Accepted Worldwide

PayPal is by far the most popular payment gateway for UK businesses. As an eCommerce business owner, it should definitely be at the top of your list.

PayPal is trusted and familiar. Most of your customers already have a PayPal account they use for other online purchases. This familiarity and trust in the brand mean customers will feel comfortable buying from you.

When it comes to features, PayPal offers the following:

- Integrating PayPal into your website or payment process typically only takes a few minutes. All you need to get started is a business account, which is free to open.

- PayPal’s fees are in line with industry standards. They charge a small percentage of each transaction, typically around 3.4% plus a fixed fee.

- PayPal uses industry-leading fraud detection systems to help prevent fraudulent transactions and chargebacks. This gives you and your customers peace of mind during the checkout process.

- If you sell products internationally, PayPal supports over 200 markets and 100 currencies around the world. Your global customers will be able to pay you in their local currency.

In summary, PayPal should be a key part of your payment gateway strategy. For small to mid-sized eCommerce businesses in the UK, it ticks all the boxes in terms of cost, security, reliability, and reach.

Stripe: Best for eCommerce

If you have an eCommerce business, Stripe should be at the top of your list of payment gateways to consider. Stripe makes it easy for customers to pay you online.

Stripe supports all major credit and debit cards as well as local payment methods in over 135 currencies. They have competitive pricing with no hidden fees. Their checkout is optimized for conversion, with a simple and secure payment flow.

One of the best things about Stripe is how quickly you can get up and running. You can create an account, add your bank details, and start accepting payments within minutes.

When it comes to features, Stripe offers the following:

- Stripe has extensive documentation with code samples in several languages to help you integrate their API.

- Stripe Radar, their fraud prevention tool, uses machine learning to detect and prevent fraudulent transactions in real-time. This helps keep your business protected.

- Stripe Billing allows you to set up subscriptions, invoices, and billing plans. You can schedule automatic recurring payments, send invoices, and manage your billing in one place.

- With Stripe Connect, you can also accept payments on behalf of other businesses. This is great if you build a marketplace or platform and need to pay out funds to third parties. Stripe will handle the transfers to your users’ bank accounts.

In summary, Stripe is an ideal payment gateway for eCommerce businesses and marketplaces. They make accepting payments online incredibly easy with competitive rates, a quick setup, extensive features, and strong fraud protection.

Sage Pay: Best for Large Businesses

Sage Pay integrates with many top eCommerce platforms like Magento, WooCommerce, and Shopify, so you can start accepting payments quickly. It also works with Sage Accounting and Sage Business Cloud solutions for streamlined business management.

Sage Pay is ideal for large businesses with high-volume transactions. Sage Pay’s pricing is tailored for enterprise businesses. The exact fees will depend on your business’s volume and average transaction size. For most large companies, the benefits of Sage Pay outweigh the investment.

When it comes to features, Sage Pay offers the following:

- Sage Pay uses machine learning to analyze transactions and detect fraud. It can block suspicious payments in real-time before they’re processed.

- Sage Pay is fully PCI DSS compliant, so you don’t have to worry about managing sensitive customer data.

- You can fully customize the checkout experience, including adding your company branding and multiple payment options.

- Robust reporting tools provide insights into sales, refunds, chargebacks, and more, so you have visibility into how your business is performing.

- Sage Pay provides dedicated support for enterprise customers. You get access to a named support contact, phone support, and a support portal with helpful resources.

In summary, with enterprise-focused features, customization options, and dedicated support, Sage Pay is an ideal payment gateway for large UK businesses with complex needs. While not the cheapest option, the value Sage Pay provides through reduced costs and optimized operations makes the investment worthwhile for most enterprises.

GoCardless: Best for Recurring Payments

GoCardless is ideal if you bill customers on a recurring basis. It specializes in direct debit payments, allowing you to automatically collect payments from your customer’s bank accounts on a schedule you set.

Its low fees, reliability, and seamless integrations make it an ideal solution for collecting regular payments from your customers month after month.

When it comes to features, GoCardless offers the following:

- It charges just 1% per transaction with a cap of £2, keeping more of your revenue in your pocket.

- You can be up and running in minutes. Just sign up, add your bank details, and you’re ready to create your first direct debit.

- GoCardless is authorized by the Financial Conduct Authority (FCA) and uses the Bacs direct debit scheme, so payments are protected.

- Although GoCardless specializes in bank-to-bank payments, it also offers pay-by-link so customers can pay one-off or recurring invoices via card if they prefer.

- The GoCardless dashboard provides an overview of all your direct debits, invoices, customers, and payments in one place.

- GoCardless integrates with many popular accounting, invoicing, and CRM software like Xero, Sage, and Salesforce.

For any UK business with a recurring revenue model, GoCardless should be at the top of your list of payment gateways to consider. By automating payment collection, you’ll spend less time chasing invoices and more time growing your business.

Square: Best for Mobile Payments

The demand for simple and practical mobile payment solutions grows as internet transactions keep increasing. Square has made a name for itself as a pioneer in mobile payment solutions by offering businesses a complete platform that syncs up with mobile devices without any problems.

Additionally, Square is ideal for up-and-coming businesses. You may immediately open your business thanks to its affordable processing costs and simple setup procedure.

When it comes to features, Square offers the following:

- Square accepts all major credit and debit cards including Visa, Mastercard, American Express, and Discover.

- Square doesn’t charge any monthly fees, setup fees, or PCI compliance fees either.

- Square deposits funds from your sales into your bank account within 1-2 business days, which is much faster than most traditional merchant services which can take 3-5 days.

- Square also offers an EMV chip card reader for accepting chip cards as well as NFC payments like Apple Pay.

- The free Square Point of Sale app allows you to accept payments, track sales, and inventory, build customer profiles, offer discounts, and send digital receipts. The app works on both Android and iOS mobile devices.

In summary, Square is an ideal payment gateway for small businesses looking to quickly and affordably start accepting credit card payments, especially through mobile devices. The fast funding, low fees, and free hardware eliminate many of the barriers that typically come with traditional merchant services.

Braintree – For Online and Mobile Payments

Braintree is a popular payment gateway option for UK businesses. It lets you accept payments on your website, mobile app, or any platform. It’s designed to be easy to set up and use.

Once you’re set up, Braintree offers competitive pricing with interchange-plus pricing and no long-term contracts. You’ll just pay a small percentage of each transaction. For most businesses, fees average 2.9% + £0.30 per transaction.

When it comes to features, Braintree offers the following:

- They don’t charge any monthly fees, setup fees, or gateway fees either.

- Braintree offers seamless integration and only takes a few minutes to set up.

- Braintree integrates with tons of eCommerce platforms such as Shopify and WooCommerce.

- Their fraud detection system monitors each transaction in real-time and uses machine learning to spot suspicious activity.

Overall, Braintree is an affordable, user-friendly payment gateway option for UK businesses. With competitive pricing, strong fraud protection, and omnichannel payment acceptance, Braintree has everything you need to start accepting payments and grow your business.

Adyen – For Fast-Growing Businesses

Adyen is one of the top payment gateways for fast-growing businesses in the UK. Adyen should be on the top of your list if you own an eCommerce business and want to grow quickly.

For receiving payments online, offline, and on mobile devices, Adyen provides a comprehensive solution. They offer sophisticated fraud prevention to secure your business and have a straightforward price structure without any additional costs.

When it comes to features, Ayden offers the following:

- You may take all forms of payment using Adyen, including Visa, Mastercard, PayPal, Apple Pay, and regional payment methods.

- Adyen offers a quick and easy account setup process and straightforward signup procedures.

- You may view your payment data with the aid of analytical reports and metrics like revenue and authorization rates are available, among others.

- Adyen provides APIs to make it simple to link your website or mobile app with their platform.

- Adyen offers support with all of your problems 24/7. They provide a skilled and professional support staff who can assist you with problem-solving and inquiries.

Adyen should be at the top of your list if you’re searching for an all-in-one solution to expand your business quickly.

Payzone: Best for in-Store Payments

Payzone is one of the UK’s leading payment service providers, offering card payment processing for businesses with a physical retail presence. If you own a shop, restaurant, or other establishment where customers pay in person, Payzone should be at the top of your list.

Payzone offers highly competitive transaction fees for debit and credit card payments. They don’t charge any monthly fees, setup fees, or PCI compliance fees. You only pay for the transactions you process.

When it comes to features, Payzone offers the following:

- Their online merchant portal gives you access to detailed reports on all your transactions, chargebacks, and settlements.

- Payzone uses the latest encryption and security protocols to protect your customers’ payment data. They are fully PCI DSS compliant.

- In addition to card payments, Payzone also processes contactless payments, Apple Pay, and Google Pay.

- They provide countertop card terminals, portable card readers, and virtual terminals to take payments over the phone.

Payzone is an ideal payment gateway for any UK business with in-person customer interactions. Their low fees, robust reporting, stringent security, and multiple payment options can help take your business to the next level.

Worldpay: An All-in-One Payment Solution for Businesses

Worldpay is one of the UK’s most popular payment gateways for businesses. As an all-in-one solution, Worldpay lets you accept payments online, in-store, and more.

Worldpay provides omnichannel payment processing, so you can accept payments seamlessly across channels. Your customers can start a purchase on one channel and complete it on another without having to re-enter payment and shipping information.

When it comes to features, Worldpay offers the following:

- With Worldpay, you can accept all major debit and credit cards including Visa, Mastercard, American Express, and Maestro. You can also accept PayPal, Apple Pay, and Google Pay for fast and secure payments on the go.

- Worldpay offers interchange-plus pricing, so you only pay the actual cost of processing a transaction plus a small markup. There are no hidden fees or long-term contracts.

- Gain valuable insights into your business with Worldpay’s reporting tools. See reports on transaction volumes, success rates, refunds, chargebacks, and more.

- Worldpay uses the latest security protocols and encryption to keep your customers’ payment data safe. Worldpay is also fully PCI DSS compliant.

With competitive pricing, omnichannel payments, robust reporting, and world-class security, Worldpay has everything you need to accept payments and run your business. For UK businesses that need an all-in-one solution, Worldpay should be your go-to!

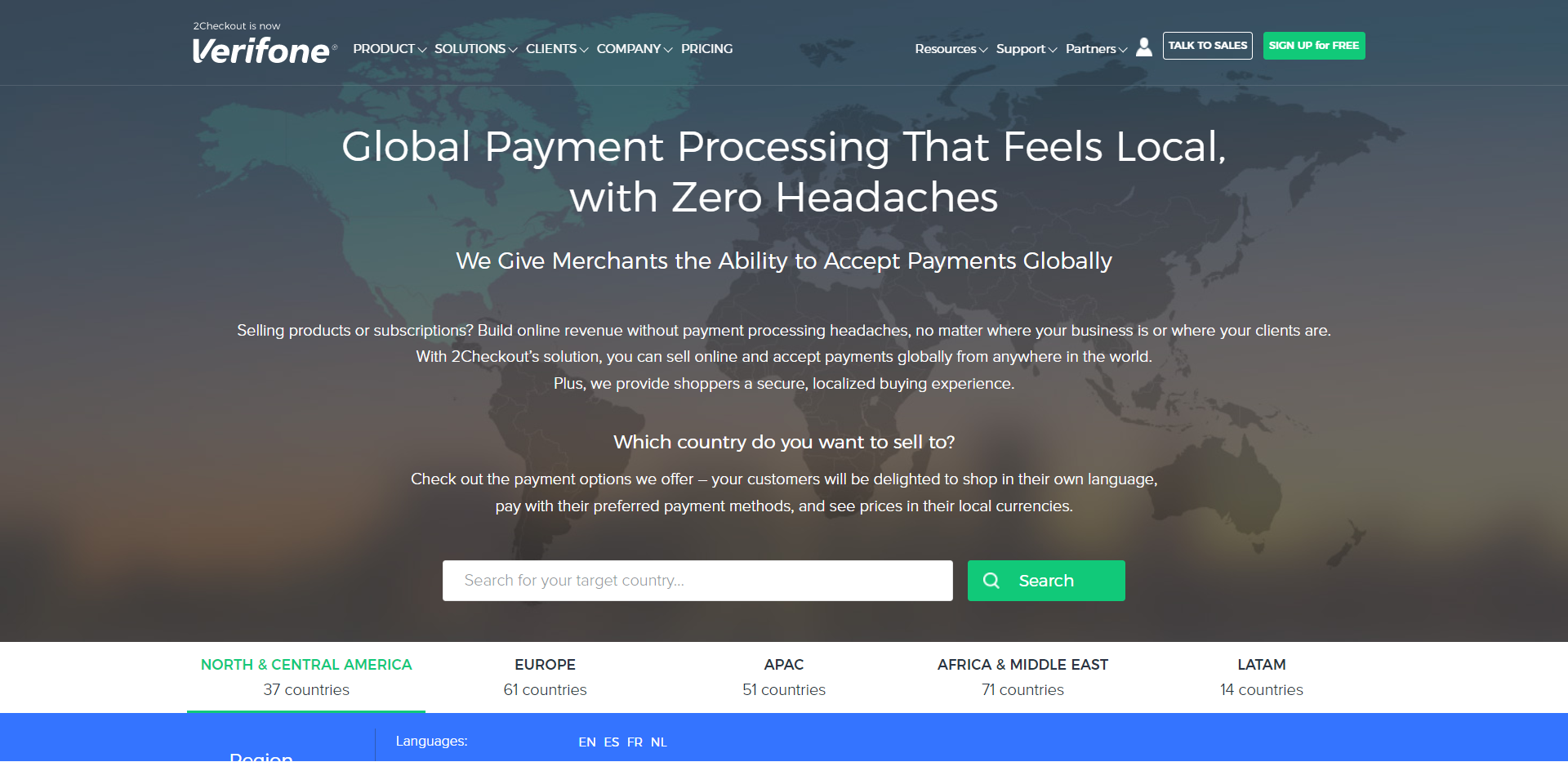

2Checkout: Now a Part of Verifone, Ideal for Global Payments

If you’re selling digital products or services internationally, 2Checkout should be at the top of your list. They make it easy to accept payments from customers all over the world in over 180 countries.

They also offer APIs to integrate with almost any system. Once set up, your customers can pay using their preferred local payment methods like credit cards, PayPal, wire transfers, and even cryptocurrency.

When it comes to features, 2Checkout offers the following:

- 2Checkout’s fees are very reasonable, ranging from 3.5% to 5.5% per transaction depending on your sales volume. They don’t charge any monthly fees, setup fees, or PCI compliance fees.

- 2Checkout integrates with all the major eCommerce platforms like Shopify, WooCommerce, and Magento.

- 2Checkout is a PCI Level 1 certified payment gateway.

- 2Checkout provides 24/7 customer support via phone, email, and live chat. Their support staff are knowledgeable, helpful, and responsive.

- As an international payment gateway, they have support available in multiple languages.

If you want to sell globally with minimal hassle, 2Checkout should be at the top of your list of payment gateways in the UK. With competitive rates, seamless integration, and world-class security, they make international payments a breeze!

Conclusion

So there you have it, the top payment gateways in the UK. Whether you’re just getting started selling online or looking to expand into new markets, choosing a payment gateway that meets your needs is key. The options we covered offer competitive rates, strong security, and global reach.

At the end of the day, the right payment gateway for you comes down to your priorities and requirements. Evaluate what’s most important, do some research on the providers that meet your requirements, and continue from there.

We hope this post has given you insight into the top payment gateways in the UK!