Let’s say you have an eCommerce business and are now ready to begin receiving payments from customers. But do you understand the difference between a payment gateway and a payment processor? A lot of people use these terms in tandem, yet they serve two distinct functions.

A payment gateway functions as the middleman for your website and your customer’s credit/debit card issuer, encrypting sensitive payment information and sending payments securely. A payment processor, on the other hand, works behind the scenes to complete the transaction by interacting with payment networks and banks to verify payments and move money between accounts.

While a payment gateway is required to accept online payments, a payment processor is required to execute the actual transaction. If you are confused, don’t worry! By the end of this article, you’ll understand the main differences and how these two components operate together to create an eCommerce website/store.

What Is a Payment Gateway?

A payment gateway is a service that actually processes credit/debit card payments for online and mobile transactions. It’s the software that securely transfers customer payment information from the merchant to the payment processor.

As an online seller, a payment gateway is essential for accepting debit and credit card payments on your website or mobile app. The gateway encrypts sensitive customer data like card numbers and CVV codes to keep it secure as it’s transmitted from the customer to the merchant.

Once the payment gateway receives the customer’s payment info, it sends it to the payment processor to verify the funds and either approve or decline the transaction. If approved, the funds are deposited in your merchant account, and the customer receives a confirmation that the payment went through.

To use a payment gateway, you’ll need to sign up for a merchant account with a bank or payment processor that partners with the gateway service. The gateway will provide you with resources to integrate their payment solution directly into your website or app.

Using a trusted payment gateway is the best way to securely accept payments online and gain your customers’ confidence.

How Do Payment Gateways Work?

So how exactly do payment gateways work? Basically, they act as the middleman between the merchant (that’s you) and the payment processor.

When a customer pays for an item on your website, the payment gateway encrypts their sensitive credit/debit card information to keep it secure as it travels from their device to the payment processor. The processor then verifies the card details and approves or denies the transaction. If approved, the funds are transferred to your merchant account.

A payment gateway utilizes the following strategies:

- The gateway routes each transaction to the correct processor based on the card type. So Visa cards go to Visa, Mastercard to Mastercard, and so on.

- It also checks the card security code (CVV) and expiration date to help prevent fraud. Some gateways offer extra fraud protection tools you can enable.

- The gateway stores customer payment information in a digital “vault” so shoppers can make faster one-click payments for future purchases. Keep in mind, the gateway never actually sees or stores your customers’ full card numbers.

- It provides reports and analytics on all your transactions, so you can track sales, look for trends, and spot potential issues.

- Most gateways offer APIs and plugins that easily integrate with eCommerce platforms like Shopify, WooCommerce, and Magento. So you can start accepting payments on your website quickly.

In summary, payment gateways handle the technical details of processing transactions, so you can focus on your business. They provide essential security, convenience, and insights, all for a small percentage of each sale.

Popular Payment Gateways

When it comes to accepting payments online, you’ll need to choose between a payment gateway or a payment processor. Payment gateways are the software platforms that facilitate the actual transaction between the customer, the merchant, and the payment processor. Some of the most popular options are:

PayPal

As one of the first digital wallets, PayPal is a trusted name for both businesses and customers. PayPal Checkout allows you to accept PayPal payments on your website. Transaction fees are 2.9% + $0.30 per transaction. PayPal also offers PayPal Payments Pro for larger businesses, which includes a virtual terminal and support for recurring billing.

Stripe

Stripe is a popular payment gateway used by many businesses. It allows you to accept payments from credit cards like Visa, Mastercard, and American Express as well as alternative payment methods like Apple Pay, Google Pay, and PayPal. Stripe charges a flat fee of 2.9% + $0.30 for each successful transaction.

Authorize.Net

Authorize.Net is a payment gateway owned by Visa that’s been around since 1996. It supports all major credit cards as well as eChecks and is compatible with over 300 shopping carts and billing solutions. Pricing starts at $25/month plus a $0.10 per transaction fee if you choose only the payment gateway. Authorize.Net is a good, low-cost option if you have an existing merchant account.

Braintree

Braintree, a PayPal service, is a popular payment gateway for mobile and web apps. It allows you to accept PayPal, Venmo, credit cards, and more with a single integration. Braintree charges a flat 2.9% + $0.30 per transaction with no monthly fees. Braintree is a great choice if you need a payment gateway with strong mobile SDKs and API integrations.

In summary, payment gateways provide the technology to process payments on your website or mobile app. Choosing a payment gateway is an important decision, so evaluate options based on your business needs and budget. If you need a better understanding of the best payment gateways in the USA, check out 11 Best Payment Gateways In The USA, and for the UK, check out 10 Best Payment Gateways In the UK.

What Is a Payment Processor?

A payment processor is a company that handles credit/debit card transactions between merchants and banks. They are a key part of the payment processing system that makes it possible for you to buy things with your credit or debit card.

Payment processors authorize credit card transactions and deposit funds into the merchant’s account. They handle the secure transmission of your payment information from the merchant to your bank or payment network (credit/debit card issuer) like Visa or Mastercard. The processor also checks with your bank to make sure the funds are available, and the card details are correct before approving the transaction.

Once approved, the processor transfers the funds from your account to the merchant’s account, minus any fees charged for the transaction. This entire process usually only takes a few seconds to complete.

Payment processors charge merchants a percentage of each transaction amount, plus a small flat fee per transaction. The fees typically range from 2-5% of the total purchase amount. The processor’s cut covers the costs of facilitating the secure transfer of funds between the customer, merchant, and banks.

In summary, payment processors play an integral role in the infrastructure that makes electronic payments possible. They facilitate the flow of funds between buyers, sellers, and financial institutions, enabling you to conveniently pay for goods and services with just the swipe or tap of a card.

How Do Payment Processors Work?

Payment processors are third-party companies that handle credit/debit card transactions between merchants and banks.

Payment processors use payment gateways to connect merchants and customers. When a customer makes a purchase on your website, the payment gateway encrypts their credit/debit card information and sends it to the payment processor. The processor then verifies the funds, checks for fraud, and deposits the money in your merchant account.

A payment processor utilizes the following strategies:

- The processor checks with the customer’s bank to make sure the account is valid and has enough money for the purchase. If not, the transaction is declined.

- Sophisticated algorithms analyze each transaction for signs of fraud, like an unusual location or large purchase amount. If fraud is suspected, the processor may decline the transaction or require additional verification from the customer.

- Once the transaction is approved, the processor deposits the funds in your merchant account, usually within 1 to 2 business days. Some processors offer faster funding for an additional fee.

- In some cases, customers may dispute charges with their bank. The processor handles the chargeback process, notifying you of the dispute and deducting funds from your account if the customer wins.

- Reputable payment processors offer 24/7 customer support in case you have questions about transactions, chargebacks, statements, or anything else. They are your first point of contact for any payment-related issues.

In summary, payment processors facilitate eCommerce by verifying transactions, preventing fraud, depositing funds, handling chargebacks, providing reports, and offering customer service. They work behind the scenes, so you can focus on running your business.

Popular Payment Processors

When it comes to accepting payments online, the top payment processors used today make it easy for both businesses and customers. These processors handle billions of transactions each year and are trusted by major companies and small businesses alike.

Chase Paymentech

One of the biggest banks in the US, JPMorgan Chase, has a payment processing division called Chase Paymentech. It provides a selection of point-of-sale (POS) systems, mobile payment solutions, internet payment gateways, and credit and debit card processing to companies.

Fiserv

A leading provider of financial technology services, Fiserv helps companies process payments. It provides a variety of services, such as card processing, accepting electronic payments, mobile payment solutions, and online payment gateways.

Elavon

Merchant services are offered by Elavon, a payment processing provider, to businesses of all sizes. It provides POS systems, internet payment options, mobile payment options, and processing for credit and debit cards.

Worldpay

Global payment processing firm Worldpay is currently a part of FIS (Fidelity National Information Services). Card processing, internet payment gateways, mobile payments, and POS (Point of Sale) systems are just a few of the many payment options it provides.

In summary, you have many excellent options when choosing a payment processor for your business. Evaluate each based on the types of payments you need to accept, pricing, available features, and ease of integration to find the right solution for your needs.

Key Differences Between Payment Gateways and Payment Processors

Payment gateways and payment processors are not the same things, even though they might have the same companies behind them (such as PayPal). Knowing the key differences between them will help you choose the right solution for your business.

Function

A payment gateway acts as an intermediary between your website and your customer’s credit card issuer. It encrypts sensitive payment information and securely sends it to the payment processor. A payment processor, on the other hand, handles the actual transaction. It verifies funds, charges the customer, and deposits money into your account.

Setup

To use a payment gateway, you’ll need to integrate it into your website’s checkout flow. This typically involves entering some code on your site to capture payment details and send them to the gateway. Payment processors, however, require a merchant account to get started. Opening a merchant account usually involves an application process where you’ll submit business documents and go through a risk assessment.

Fees

Payment gateways typically charge flat monthly fees and/or per-transaction fees for their services. Payment processors charge interchange fees (charged by card issuers), assessment fees (charged by card brands like Visa/Mastercard), and markup fees (charged by the processor). The fees for payment processing are usually higher than for payment gateways.

In summary, payment gateways handle the technical aspects of payments by encrypting and sending payment data between your site and the payment processor. Payment processors, on the other hand, facilitate the actual money transfer by validating transactions, charging customers, and depositing funds into your account, though at a higher cost. For most businesses, using a bundled gateway and processor solution is the most convenient option.

How They Work Together

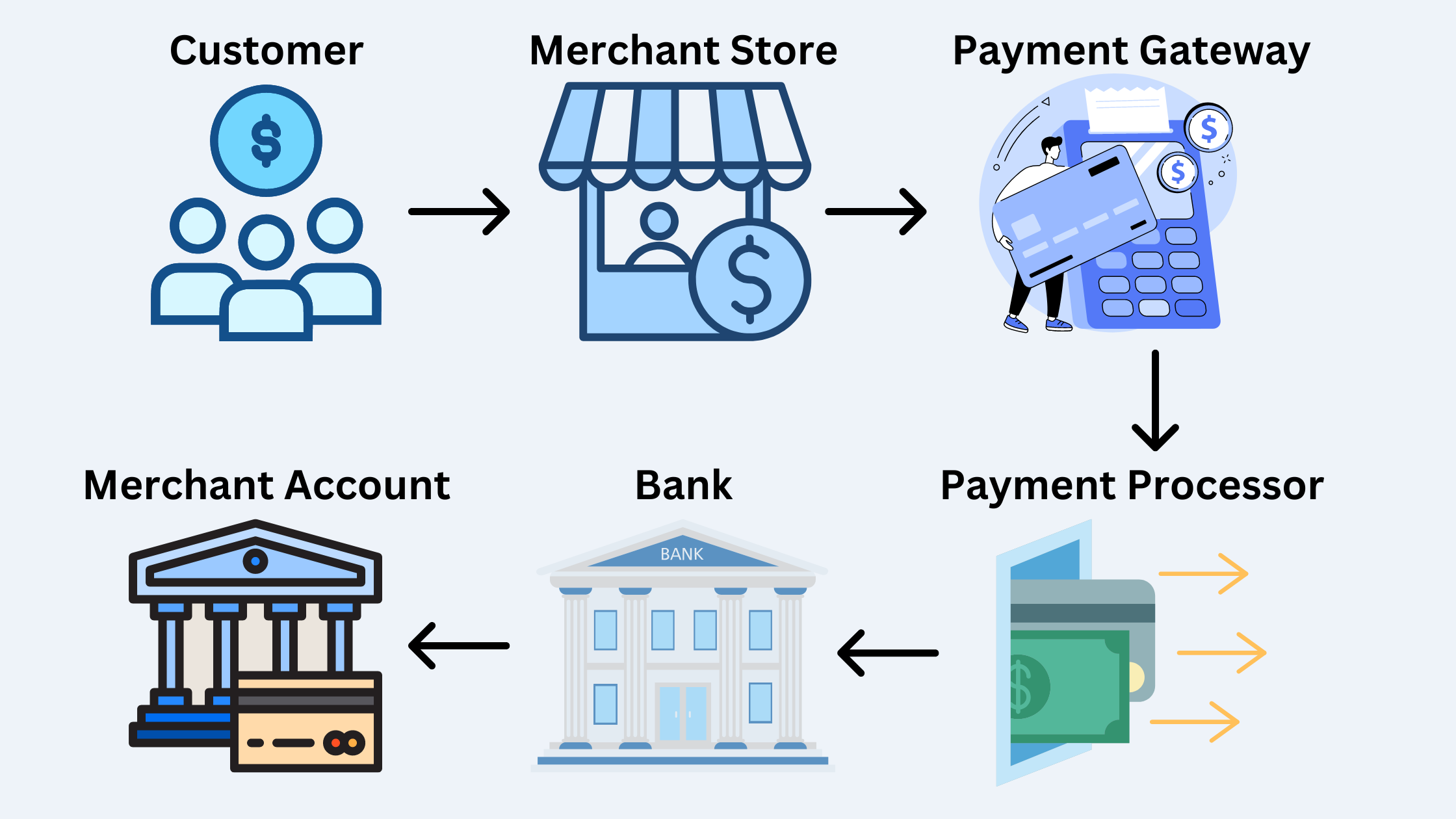

Payment gateways and payment processors collaborate to make online transactions possible. While they have distinct roles, their collaboration is what makes eCommerce possible.

Payment Gateway: The Virtual Terminal

The payment gateway acts as a virtual terminal for processing credit and debit card payments. It encrypts sensitive card information and securely sends it to the payment processor for authorization and settlement. The gateway also communicates the response from the processor back to the merchant and customer.

Payment Processor: The Disbursement

The payment processor, like Chase Paymentech or First Data, physically moves money between the customer’s bank account and the merchant’s account. They authorize transactions by verifying the customer’s card details and available funds before approving or declining the sale. Once approved, they will deduct the payment amount from the customer’s account and deposit it into the merchant’s account, minus any processing fees.

This seamless collaboration facilitates over $6 trillion in eCommerce transactions every year. By understanding how these two systems work together, you can optimize your payment processing and provide the best experience for your customers.

Conclusion

So there you have it! Now you understand the key differences between payment gateways and payment processors. While they work together to facilitate online transactions, they play very distinct roles.

As an online business, choosing the right payment gateway and processor is crucial to providing a seamless customer experience. Do your research, compare options, and make sure any solution you choose is compatible with your business needs and budget. Most platforms like PayPal, Square, Braintree, Worldpay, and more offer both services combined.

At the end of the day, each party will be more satisfied the quicker and easier a customer can make a payment and you can accept one!

We hope this post has helped you understand the difference between a payment gateway and a payment processor!