Let’s say that you started an online store and are on the path to making a good number of sales! Now it’s time to take a look at how much you’re paying in payment gateway fees with each of these transactions.

As a merchant, payment processing fees can take a big bite out of your profits if you’re not careful. The good news is there are several ways you can optimize your payment gateway charges and keep more of the money you make from sales.

In this guide, we’ll walk you through the key steps every merchant should take to reduce payment processing fees, increase profits, and build a more sustainable business. By the end, you’ll have actionable tips to implement right away and start saving money with each sale. Let’s dive in!

What are Payment Gateway Charges?

When you sign up to accept payments on your website, you have to go through a payment gateway. They process the transactions for you, but charge fees for their service.

Payment gateway fees typically include:

- A flat per-transaction charge (usually a percentage of the sale plus a fixed amount, like 3% + $0.30 per transaction).

- Monthly or annual account fees to maintain your gateway account.

- Chargeback fees if a customer disputes a charge.

- Additional fees for add-on services like fraud prevention tools or a virtual terminal.

The fees can really add up, especially if you have a high volume of transactions. But there are a few ways to optimize your payment gateway charges:

Choose a gateway with a simple, transparent fee structure: Some gateways offer tiered pricing or monthly minimums that end up costing you more. A flat-rate gateway with no hidden fees is your best bet.

Negotiate the best rates: Gateway fees aren’t set in stone. Ask if they offer discounts for nonprofits or high-volume merchants. Get quotes from multiple gateways and see if one will match or beat the others.

Process payments efficiently: Minimize chargebacks and refunds which lead to extra fees. Make sure transactions are processed smoothly the first time.

Consider an alternative: Some merchants use eWallets, direct bank transfers, or digital currencies to avoid the traditional payment gateway model altogether. They’re not for everyone but may be an option if fees are a concern.

Optimizing your payment gateway doesn’t have to be complicated. A little research and efficiency can help keep more of your money in the bank where it belongs.

Before we go into detail on how to optimize these charges effectively, let us take a look at a few benefits of doing so.

Benefits of Optimizing Payment Gateway Charges

Optimizing your payment gateway charges can benefit your business in several ways:

Cost Savings

Reducing fees means more revenue in your pocket. Even shaving off a fraction of a percentage point from your rates can equal big savings annually. Renegotiating contracts, choosing a lower-cost provider, or optimizing your account setup are all ways to lower fees.

Fraud Prevention

The more transactions you process, the bigger a target you become for fraud. By streamlining your payment flow and security measures, you make such occurrences more difficult while providing a good customer experience. This protects your revenue and your customers.

Customer Satisfaction

Nobody likes paying more fees than necessary. By providing the lowest-cost, most frictionless payment experience possible, you build goodwill and loyalty with customers. They’ll appreciate your efforts to save them money and hassle.

Now let us look at a few measures to optimize these payment gateway charges.

Understanding Payment Gateway Pricing Models

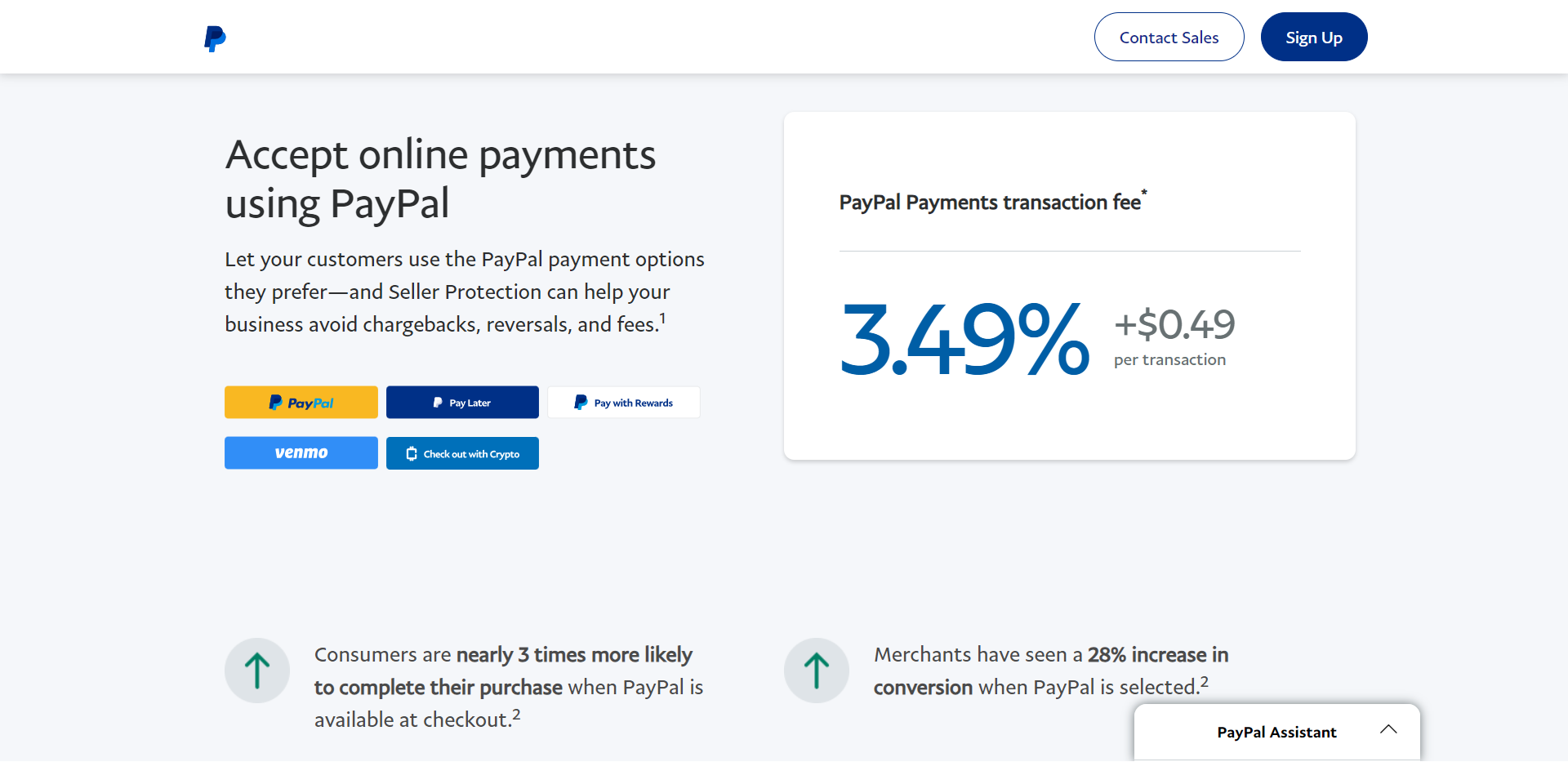

Image Source: https://www.paypal.com/us/business/pricing

To get the best rates on payment gateway fees, you need to understand the pricing models. Most gateways charge either a flat rate, interchange-plus pricing, or a tiered rate.

Flat rate: This is straightforward but often the most expensive. You pay the same rate for all transactions, typically a percentage like 3% + $0.30 per sale.

Interchange-plus: This includes interchange fees charged by card brands like Visa and Mastercard, then adds a small markup. Usually, the most affordable model if you have a higher volume. Rates vary but average 0.5% + $0.10 per transaction.

Tiered rates: These charge different percentages based on the card type and volume. Rewards cards like Visa Signature maybe 1.95% while regular Visa cards maybe 2.95% as well the number of transactions that occur in your store makes a difference in the tier rate. Tiered seems appealing but often ends up costing more.

The model you choose depends on your business and sales volume. If just starting out, a flat rate keeps things simple. But as you scale, consider an interchange-plus model to save on fees. Compare rates from different gateways to find the best deal for your needs.

Negotiating Lower Interchange Fees With Your Payment Gateway

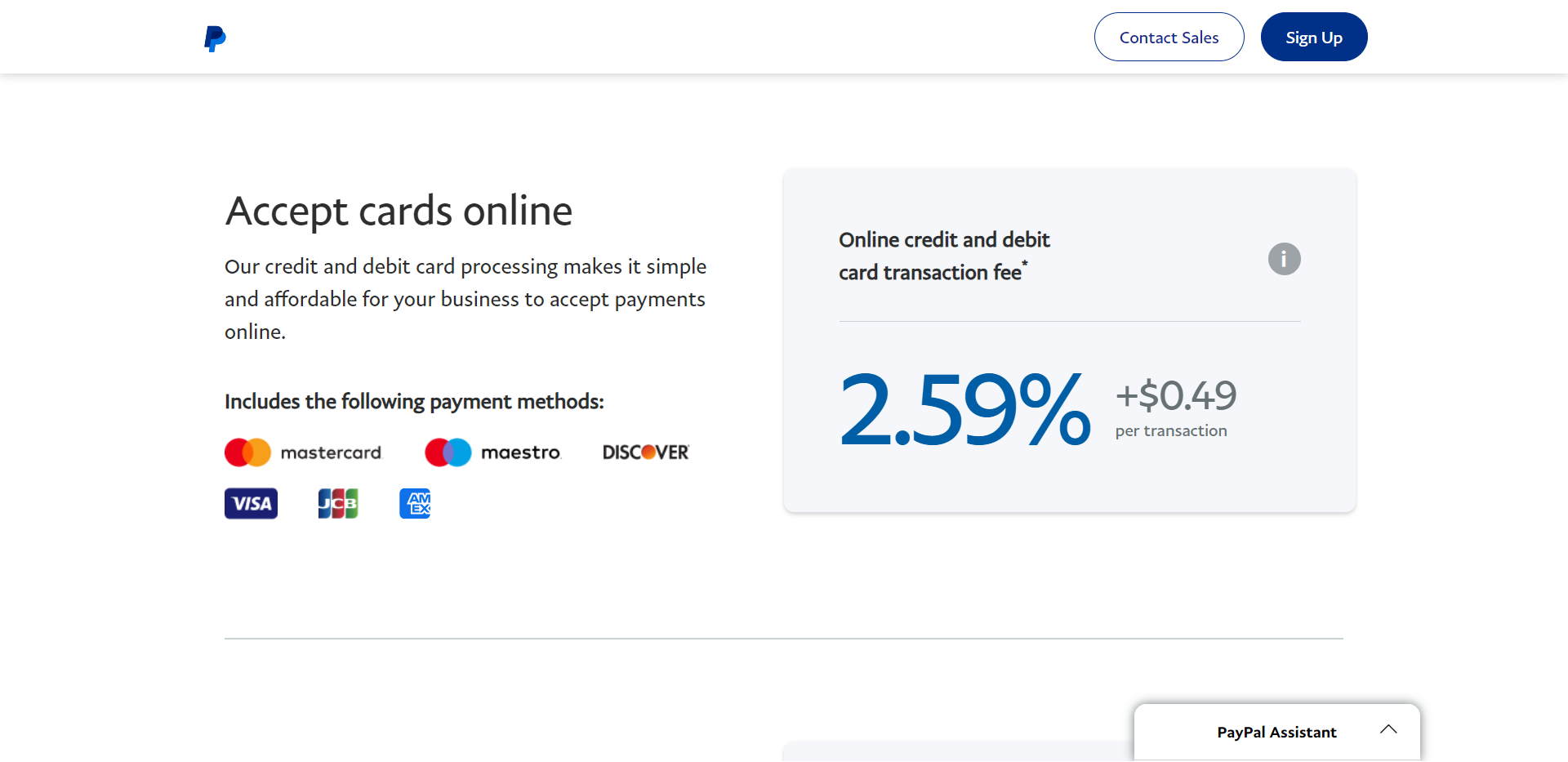

Image Source: https://www.paypal.com/us/business/pricing

Interchange fees are charged by card issuers like Visa and Mastercard for processing credit and debit card transactions. These fees make up a large portion of the fees charged by payment gateways. As a merchant, you have the power to negotiate lower interchange fees with your payment gateway.

Do some research on average interchange fees for your industry and transaction types. Then, contact your payment gateway and request a reduction in the interchange fees they’re charging you, explaining that their rates seem higher than competitors. Many payment gateways will work with merchants to lower fees in order to retain your business. You can ask for a percentage point or two reduction to start and renegotiate again in the future.

If your payment gateway is unwilling to budge on interchange fees, it may make sense to look at other providers. Switching payment gateways is a hassle, but the savings on interchange fees alone may be worth it, especially for high-volume merchants. Lower fees mean more money in your pocket at the end of the day.

Renegotiating with your existing payment gateway or finding a new one with lower interchange fees are two of the easiest ways for merchants to reduce overall payment processing costs.

Reducing Per-Transaction Fees Through Volume Discounts

Once you start processing a higher volume of payments, you can often negotiate lower per-transaction fees with your payment gateway. Many gateways offer tiered pricing models where the more you process, the less you pay per transaction.

Ask your payment gateway about volume discount tiers and the rates for each level. For example, they may charge 2.9% + $0.30 per transaction for up to $10,000 in monthly volume, 2.5% + $0.30 for $10,000 to $50,000, and 2% + $0.30 for over $50,000. If your current monthly payment volume will soon pass into the next tier, you may be able to lock in the lower rate in advance.

- Track your monthly payment volume and see if you’re close to reaching the next tier in the pricing model. If so, contact your payment gateway and request the lower per-transaction fees before you officially pass into that volume level.

- Explain that you want to benefit from the volume discount as soon as possible. Many gateways will work with merchants to provide the best possible rates for their needs and overall payment processing volume.

Lower per-transaction fees, even by just a few tenths of a percent, can save you hundreds or even thousands of dollars per month once you reach higher payment volumes.

Optimizing Your Payment Gateway Settings

Reduce your MDR

To optimize your payment gateway charges, negotiate your Merchant Discount Rate or MDR. This is the percentage charged per transaction to process payments. Even shaving off 0.1% can save you money on a larger scale.

Enable surcharging

If permitted in your country and for your industry, consider passing on some or all of the payment processing fees to your customers through surcharging. This can allow you to maintain your profit margins without raising prices across the board. However, it may turn off some customers, so weigh the pros and cons for your business.

Disable unused payment methods

Only enable the payment methods you actually accept and process payments for. If you only take major credit cards, turn off ACH, PayPal, etc. The more payment methods you have active, the higher your monthly gateway fees will be. Reduce any unused options to cut costs.

Keeping an eye on your payment gateway charges and making a few optimizations can help streamline your expenses over the long run.

Considering Alternative Payment Methods

To reduce payment gateway fees, consider accepting other popular payment methods beyond just credit cards. These alternative options typically charge lower transaction rates for merchants.

- Digital wallets like PayPal, Apple Pay, and Google Pay are convenient for customers and charge lower fees. Linking to these services is easy to set up and can save you around 2-3% per transaction.

- Buy now, pay later options like Afterpay are popular with younger customers. While they do charge initial setup and ongoing monthly fees, the transaction rates are usually under 2%.

- Cryptocurrencies like Bitcoin and Ethereum are volatile but essentially fee-less. If you’re willing to accept the risk, crypto can eliminate payment processing fees.

- Bank transfers and wire payments via services like TransferWise or WorldRemit offer some of the lowest rates at around 1% or less per transaction. However, funds may take 1 to 2 business days to clear.

By diversifying the payment methods you accept, you can optimize your payment gateway charges and pass some of the savings on to your customers through lower prices.

Reduce Chargebacks and Fraudulent Transactions

To reduce chargebacks and fraud, take the following steps:

Monitor Transactions Closely

- Keep a close eye on transactions, especially larger ones. Look for any suspicious activity like multiple orders from the same IP address or billing address. Fraudsters often test stolen cards with small purchases first before making larger fraudulent buys.

- Check the Address Verification Service (AVS) codes on transactions. Invalid or non-matching codes could indicate fraud.

Require Strong Passwords

- Require customers to use strong, unique passwords to log into their accounts. Weak, reused passwords are easy targets for fraudsters. Enable two-factor authentication if possible for an extra layer of security.

Stay Up-to-Date on Fraud Prevention

- Fraud techniques are constantly evolving, so merchants need to stay up-to-date with fraud prevention best practices. Follow guidelines from your payment gateway and card networks on fraud detection. Consider using third-party fraud prevention tools which use machine learning to detect anomalies.

Issue Refunds Promptly

- If you do receive a legitimate chargeback, issue a refund promptly. The quicker you refund the customer, the less likely the issue will escalate further. Work to resolve the underlying issue, whether it’s a customer service failure or fraud that slipped through the cracks.

Taking a proactive approach to security and fraud prevention is the best way for merchants to reduce chargebacks and keep their payment gateway charges low.

Optimize Your Payment/Checkout Flow

A lengthy or complicated checkout process can increase cart abandonment and hurt conversion rates. Review your payment flow and look for ways to simplify the experience for customers.

- Reduce the number of steps: If customers have to click through several pages to enter payment info, shipping address, and billing address, it can feel tedious.

- Minimize form fields: Only ask for information that is absolutely necessary to complete the transaction.

- Offer guest checkout: Forcing customers to create an account to make a purchase is an extra step that may drive some away. Allow guest checkout as an option.

- Save payment info for repeat customers: If customers have purchased from you before, save them time by pre-populating forms with details from their previous orders. Only go ahead with this if the customer opts for the same.

- Clearly display payment methods: Make sure popular payment methods like credit cards, PayPal, Apple Pay, and Google Pay options are prominently visible. The easier you make it to pay, the more likely a customer will complete their purchase.

Streamlining your payment flow and checkout process can have a significant impact on sales and chargebacks. Look for ways to simplify the experience, minimize distractions, and get your customers to the final sale page as quickly and smoothly as possible.

Conclusion

So there you have it, a few simple yet crucial ways to optimize your payment gateway charges and keep more of your revenue. With consistent optimization, the benefits to your business can be huge.

Optimizing your payment gateway should be an ongoing process of evaluation and improvement. Regularly review statements to catch errors or unauthorized charges. Explore new technologies and services that could reduce costs or improve the customer experience.

We hope this post has helped you optimize payment gateway charges for your eCommerce store!