Are you shipping internationally? Here is a quick guide on import duty and details about who pays it.

What is Import Duty?

Import duty is a tax that is imposed on goods that are imported from other countries. The government puts up an increased price on the goods that are imported from other countries to make these products less desirable so that customers are encouraged to purchase domestic goods. You might see the words duty and tariff used interchangeably, but if you watch it closely you’ll see some difference.

A tariff is the value of a taxed percentage of an item. For example, when you are importing a carpet to the United States, US customs will charge a tariff of 4.5%.

Import duty is actually the amount paid on the imported product and its value completely depends on the quantity that is imported. For example, if you are importing a carpet worth $100,000, then the import duty would be $4500.

The importance of import duties in eCommerce

It is important to understand the duties and tariffs when you are a part of eCommerce global trade. The duties do affect your online business greatly in terms of the final price of the product being imported. With eCommerce trending and online shopping expanding its coverage globally, it is quite important to know how the import duties and taxes are affecting the overall business transaction.

Prepare your customers for paying import duties

It is always necessary to keep your customers informed about the import duties and tariffs so that they are not taken by surprise. You can effectively communicate the import charges for the products on the checkout page, product pages, or email confirmations.

For example, when you are shipping an item wherein you do not want to include the duty to be paid for the item, then you can make use of DDU. This way the shipment’s overall cost will be reduced. But as a seller, it is important to notify your customers that you have not processed the duty charges for the shipment. On the other hand, in the case of DDP, you have already made the duty payment for the shipment, so that your shipment will be quickly processed at the customs without much hassle.

Choosing DDU or DDP is up to the seller or the business model they work with.

Learn more about DDU Vs DDP here and how they can be included in your eCommerce store.

Calculating import duties

Import duties differ with the country. Duties are basically calculated as the percentage of the customs value, the insurance on the product, and the shipping charge.

You can get a better understanding of shipping duties and taxes from this article.

How to include Import Duty charges on your products in your WooCommerce store?

Mostly the duty on items that are imported to a country is determined with the help of the HS Tariff number of the product. The code helps to identify the product or type of product that is being shipped and then relevant taxes are applied. In most cases, the value of goods includes the freight charges as well as the insurance fees too. In order to understand who pays the taxes, it is important to get a clear understanding of the Incoterms on the commercial invoice, which clearly defines who will pay the taxes, duties, as well as shipping costs.

For example, if you want to include the HS Tariff number on the products, you can do it on the individual product page.

This way it becomes easy to identify the products during customs checks, and the charges can be applied accordingly. You can implement this using a simple shipping plugin ELEX WooCommerce DHL Shipping Plugin on your WooCommerce store.

The plugin also lets you print commercial invoices right from your store, which is indeed one of the important documents that need to be accompanied by the item being shipped.

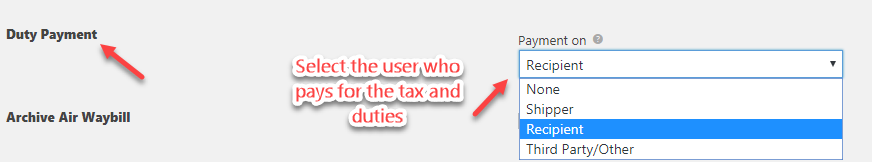

Also, if you want to set who pays the duty, you can do it easily using the plugin settings. This way, you can add the import duty charges on your store beforehand, ensuring that your customer is informed prior to shipping.

By including these data in your store, while processing the order, the customer also gets informed about the duty that is charged on the shipment. If you are looking for a third-party option, then you need to depend on customs brokers who will pay the charges on behalf of you and your customer.

To Conclude,

As we discussed above regarding the import duty on your shipments, it is important to keep in mind that these charges are to be paid and cleared in order to have a swift clearance from the customs. If you do not want to create complications in your taxes, then it is always better to pay the duties and taxes correctly. In the case of international shipping, you ought to pay the import duty to ensure that your business is not impacted, and you can continue a healthy tie-up with the countries you are shipping to.

Further Reading: