International shipping is indeed a labyrinthine process and needs lots of attention to detail. You will need to figure out things like if your product is a restricted or prohibited item in the countries you are shipping to. Also, you need to find out about the taxes and duties of the countries you are shipping to. To make shipping simpler, most of the countries have adapted the harmonized system for international shipping. Since 1988, with the implementation of the harmonized system, navigation through the customs has become easier and manageable. Using the harmonized system, it becomes easy to identify the products both for the seller and the customs duty officers.

What is the Harmonized System?

Harmonized System, popularly referred to as HS code, is an internationally accepted list of commodity descriptions and codes that help classify products being traded across borders. It helps different countries easily recognize products and categories being shipped and find out what taxes to impose on them. WCO or World Customs Organization developed this harmonized system and is being used by more than 200 countries. This code simplifies the classification of goods that are shipped, which eases the international shipping process. This unified process, it creates a standard procedure for sharing trade information. In short, it helped the customs processes to speed up and deal with the overall process in an efficient manner.

The WCO ensures that the system is followed by all the international trades in a uniform way. The uniform interpretation of these codes, it helps to streamline international shipping. The HS code is also updated timely to reflect the technology and trade pattern developments. Most of the time the HS tariff codes are updated every five or six years.

How is the Harmonized System Used

The HS code is basically a six-digit code no matter which country you are operating from. However, each country can add additional digits to specify the products more clearly. For example, the US adds four more digits to the product HS code to clearly explain what product is being shipped; Japan uses unique three-digit codes for the same purpose.

The HS code looks like 6 digits, for example, 660110. This is the HS code for garden umbrellas. So here if you see the code, the first four digits 6601 represent the code for an umbrella. Hence if you are shipping a sun umbrella you might use the code 660199, where the last two digits specify what type of umbrellas are being shipped.

You can find the HS tariff codes on several websites as these codes are universal and widely accepted for trading. When you are shipping internationally, you need to make use of this harmonized code for shipping. This harmonized code is used on the shipping labels, which helps customs to identify the product easily. The harmonized shipping code or HS tariff code is displayed on the left box of your international customs form.

How can you include the Harmonized System in your WooCommerce store?

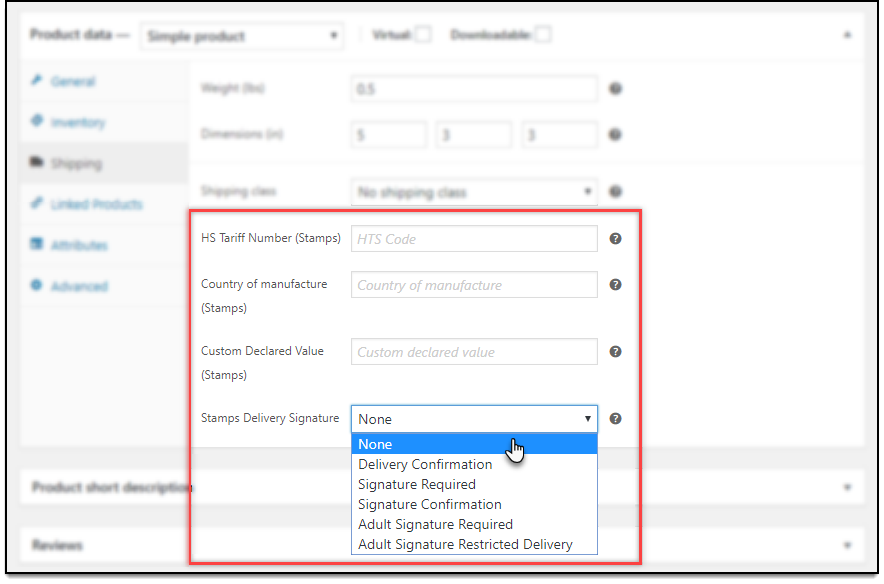

If you want to use the Harmonized System or the HS code on your WooCommerce store, you can add the data to the products in the WooCommerce individual product settings.

Go to the Product page dashboard > Product data meta box > Shipping

Here in these settings, you can provide the HS Tariff Number in the shipping settings of the individual product.

This code will be used to classify the product on the shipping label or even on the commercial invoice accompanied by the products.

Which Countries Use the Harmonized System?

More than 200 countries use the harmonized systems or the HS tariff code for shipping. The inclusion of the HS code in the commodity makes the customs process go easy. Most of the countries linked with international shipping use the HS code such as India, Canada, the US, the European Union, etc.

How Beneficial is the System For eCommerce Retailers?

There are so many advantages when it comes to using the Harmonious System code in shipping.

Advantages

- Regulated process for classifying the products precisely making trading easier.

- Assessing the custom and duties becomes more lenient.

- Shipping becomes faster and easier.

- Easy to collect the trade data.

- eCommerce retailers fulfill a legal obligation by using these HS tariff codes for shipping.

- Boosts productivity in the shipping process.

- Handling the products for shipping becomes easier.

- Assures that trade policy are updated and relevant when it comes to international shipping.

- HS Tariff code forms a common language in commercial practices and trade negotiations which makes international shipping work well.

Disadvantages

There are certain disadvantages when you are using the HS tariff code too. They are:

- When not used properly, duty and taxes can be levied, making products costlier for consumers

- Since the last digits after the HS code are different for different countries, you might end up defining a different product for your customer’s country when you mention it on your commercial invoice.

- Can result in cases of fraud if the wrong HS code is used for shipping purposes.

Ship Better With Harmonized System

Dealing with duties and taxes while selling internationally is quite common. To make things easier, you can have a Harmonized system which makes it much more organized. The code helps to identify the products that are being shipping and helps international shipping carriers deal with the customs in a streamlined manner.

Further Reading: