In this article, we are going to discuss how ELEX WooCommerce DHL Shipping Plugin with Print Label helps WooCommerce store owners to generate and print complaint customs documents. We’ll start with the common reasons your packages are held at customs and their respective solutions.

‘Held at Customs‘ means the package you are sending to the destination country is held by the officials of the importer country’s customs office. These government bodies hold the packages until they ensure that only permissible items cross their border and the taxes (Duties & Excise) are paid for the import. These bodies also make sure that the legal ownership and control of the product is handed over to the right party.

So if you are a relatively new e-commerce store owner, your package getting held at customs may become a common phenomenon. Lesser experience, less information and not using the right resources are the main reasons your packages may be held at customs. While you are still unaware of the rules and regulations, you can take help from your shipping partner or a third-party broker. They help you prepare the correct documents and pays for the duties without any hassles.

Reasons Your Packages are Held at Customs

There are multiple reasons you might get the message “Held at Customs”. Some of the most prominent of them are:

- Incomplete Documents

- Unpaid Customs Duties

- Sending Restricted or Prohibited items

So, if there are even slight mistakes in these documents or there are unpaid duties, you may end up wasting weeks just to get the package cleared through customs. To avoid this, you need to have a greater insight into these common issues. Let’s explore:

Incomplete Documents

Attaching an incomplete document to your package is one of the main reasons your package may be ‘Held at Customs’. If there are errors or some important information is missing from the documents you submit, your package may be held by the customs.

The list of documents may vary for different products and the country you are shipping to. But there are few documents that are common and are mandatory to be attached to all your packages. These documents are actually divided into subcategories to help you find out the right document required at each step.

COMMON DOCUMENTS

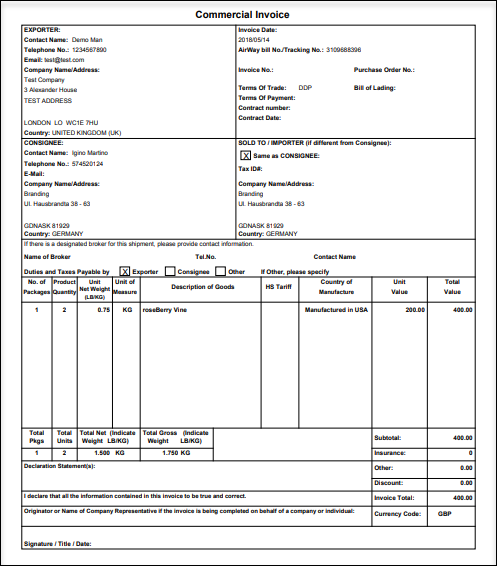

- Commercial Invoice cum Packing List – It is a bill for goods that the seller sends to their customers. It can be the invoice you generate on your own or by using shipping software. These invoices are used to determine the value of the products being imported and apply the duties accordingly. If any country uses only these invoices for controlling their customs, they specify its format, number of copies you need to submit, its language, and other details required. WooCommerce DHL Shipping Plugin with Print Label helps you print a detailed invoice which includes:

- The seller, buyer, and shipper details

- Invoice number and the date of shipment

- Mode of transport and the carrier

- Itemized quantity, description, the type of packages, such as a box, crate, drum, or cartoon

- The number of packages, total net and gross weight (in kilograms/pounds), and dimensions, if required.

TRANSPORTATION DOCUMENTS

- Airway Bill- Shipments shipped via Airfreight require airway bills. You can ask for an airway waybill from your shipper. If you are using their online APIs, you can easily archive air waybills with ease.

- Bill of Lading- It is the agreement between the shipper/owner and the carrier of the package. It should include the Content description, Address of shipper and recipient, etc.

- Electronic Export Information Filing (formerly known as the Shipper’s Export Declaration)- You’ll need to fill this online form if the package is valued at more than $2,500. Also if the product requires an export certificate this form is mandatory to be filled.

EXPORT COMPLIANCE DOCUMENTS

- Export Licenses- An export license is a government document and it authorizes the export of specific goods in specific quantities to a particular destination. This may be required by almost all exports to some countries or other countries for some specific products.

- Destination Control Statement- This statement is required for exports from the US for products listed on the Commerce Control List that are outside of EAR99 or controlled under the International Traffic in Arms Regulations (ITAR). This statement should be printed on the commercial invoice, ocean bill of lading, or airway bill to notify the carrier and all foreign parties that the item can be exported only to certain destinations.

CERTIFICATES OF ORIGIN

- Generic Certificate of Origin- You can prepare this document with the help of the product manufacturer and get it certified by a competent government body or the chamber of commerce. Including the country of manufacturing on all your labels is strongly recommended.

OTHER CERTIFICATES FOR SHIPMENTS OF SPECIFIC GOODS

- Dangerous Goods Certificate and Radiation Certificate- If you are shipping dangerous products across the borders shipped through air carriers or air freights, include a Shipper’s Declaration for dangerous goods. This declaration is required by the International Air Transport Association (IATA) for safety purposes. You should ensure the information provided about the content, packaging, and other information is correct, as the signee remains the one who will be responsible for the product.

- Halal Certificate– The Middle East is a huge market for meat and if you are shipping meat to these nations make sure you have a Halal Certificate. This makes sure that the meat or the poultry is slaughtered in accordance with Islamic laws. These certifications should be obtained by appropriate chambers and legislation by the consulate of the destination country.

- Insurance Certificate- If the product you are sending is insured by the carrier or a third-party insurance provider, the receipt you receive serves as the certificate. In case, the insurance is bought through online integrations the waybill or the labels have the insurance details on them. Some countries may require a separate certification for this.

- Dock Receipts- A dock receipt provides the shipper a receipt that the package is received by the carrier successfully and the package is in the best condition for exports.

Customs Duties

As per US Customs and Border Protection,

“The Harmonized Tariff System (HTS) provides duty rates for virtually every item that exists. The HTS is a reference manual that is the size of an unabridged dictionary”.

As we know that globalization has eliminated most physical borders when it comes to markets, but when you want to ship the products around the world, they go through the customs check. Customs are government body which charges duty on the products that come in or goes out of a nation’s borders. Customs duties ensure that there is a balance between the economies of different countries. As a result, product prices are neutralized based on the destination country or the country of origin/manufacturing. One more reason for such duties is the protection of domestic industries so that if an overseas competitor is selling products at lower rates, their products will be levied to match the domestic market price. And, If you fail to pay the proper duty rates, your packages will be held by customs until dues are cleared.

If you are based in the US, visit US Tariff Database for an interactive database that will enable you to get an approximate idea of the duty rate for a particular product. The duty rates are returned as per the information you provide to the customs. It may happen that the actual duty rates are way different than the ones you calculated. Only the importer country’s customs determine the correct rate of duty.

There are different ways you can keep up with customs duty rates. A few of them are:

- Do proper research on a personal level and pay for the duty by yourself

- Take assistance from the dedicated customs brokers from your shipment carriers like USPS, FedEx, DHL, UPS, etc.

- Use a third-party broker to pay for customs duties.

Restricted or Prohibited Items

No government wants to allow its people to obtain illegal items or get them playing around with the laws. So if you are sending the following products your packages will be held at the customs check.

- any product which is illegal in the destination country or

- the product is infected with some disease or micro-organisms that can affect life in the destination country

- products you sell is against the domestic interests of the people and industry in the destination country

- A product that is restricted and can be imported only after proper checks

- Political reasons

Export.gov is the website you can check for an updated list of products that are on the prohibited and restricted lists in all countries around the world.

How does ELEX WooCommerce DHL Shipping Plugin help with Customs Compliance?

Print Correct Waybills

ELEX WooCommerce DHL Shipping Plugin helps you print complete customs-compliant documents for DHL Express from within your WooCommerce Dashboard. While you set up the plugin you enter all the information required to print customs compliant labels. The shipping address is taken from the address entered by customers at the cart and checkout pages.

An incomplete shipping address may also cause unwanted problems like returns and refunds, so it’s good if you use address validation. A correct shipping address will also help the package cross the customs check with ease. Read why address validation is necessary for an error-free delivery!

Along with this, you get to print commercial invoices for each package which are necessary for international deliveries. These commercial invoices include details like exporter, consignee, importer, order dates and time, bill of landing, list of products, HS Tariff, country of origin, package declared value, box dimension & weight and declaration from the sender. In other words, the commercial invoice printed through the plugin is ready to use the invoice and abides by the customs regulations.

The entries in these commercial invoices are based on guidelines by DHL, which is a world leader in international logistics. So you if you have all the necessary information entered, you’ll get the correct commercial invoice.

Include Special Services

As we saw that there can be a number of products that are restricted in many countries and are allowed only when there is a declaration is available on the shipping labels or the commercial invoices. This plugin makes it easy for you to select the correct declaration for the type of product it is. This also mentions the Hazardous Material warning on the labels. You can select these special services for each product or select a default special service if you sell a single product like an alcoholic beverage or a lithium-ion battery.

Apart from special services, you can set the HS Tariff Number and the country of manufacture for the products in the Products Shipping settings. These details help the customs calculate the correct duty rates for it. Entering these details is necessary as they are printed on the commercial invoices just the way you enter them here.

To find the Product settings, go to your WooCommerce Dashboard and click on Products to get the list of products you have on your website. Now click on any product you want to have these details. Scroll down to find the ‘Product data’ and click on Shipping (screenshot above).

Selecting a Default Special Service

Select a default special service for all the products from the Special Service drop-down menu in the Label and Tracking tab of DHL Express.

Once you select a default service, you can enter a Default UN Number. UN numbers (United Nations numbers) are used to identify the type of hazardous items, which are supposed to be transported internationally. These are four-digit numbers given to a particular product or a group of similar materials. Different UN Numbers may also be provided to solids and liquid phases of a single chemical as they mostly differ in their reactive properties. Acids, which have different levels of purity may also get different UN numbers. UN numbers range can be anything between UN 0004 to about UN 3534.

Choosing Who Pays the Customs Duties

The plugin helps you choose who pays for the duties. You can choose from:

- Shipper– If you are the shipper, select shipper if you are going to pay for the customs duty. To avoid any complications do proper research on the duty rates.

- Recipient– You can also choose your customers to pay for customs duties. In case you choose this option, make sure you let your customers know about this during the purchase of the product.

- Third-Party/Other– If you want your broker or a third-party to pay for the customs duty, choose the option and enter the Duty Account Number of the broker. This is one of the most used and secure customs duty payment methods.

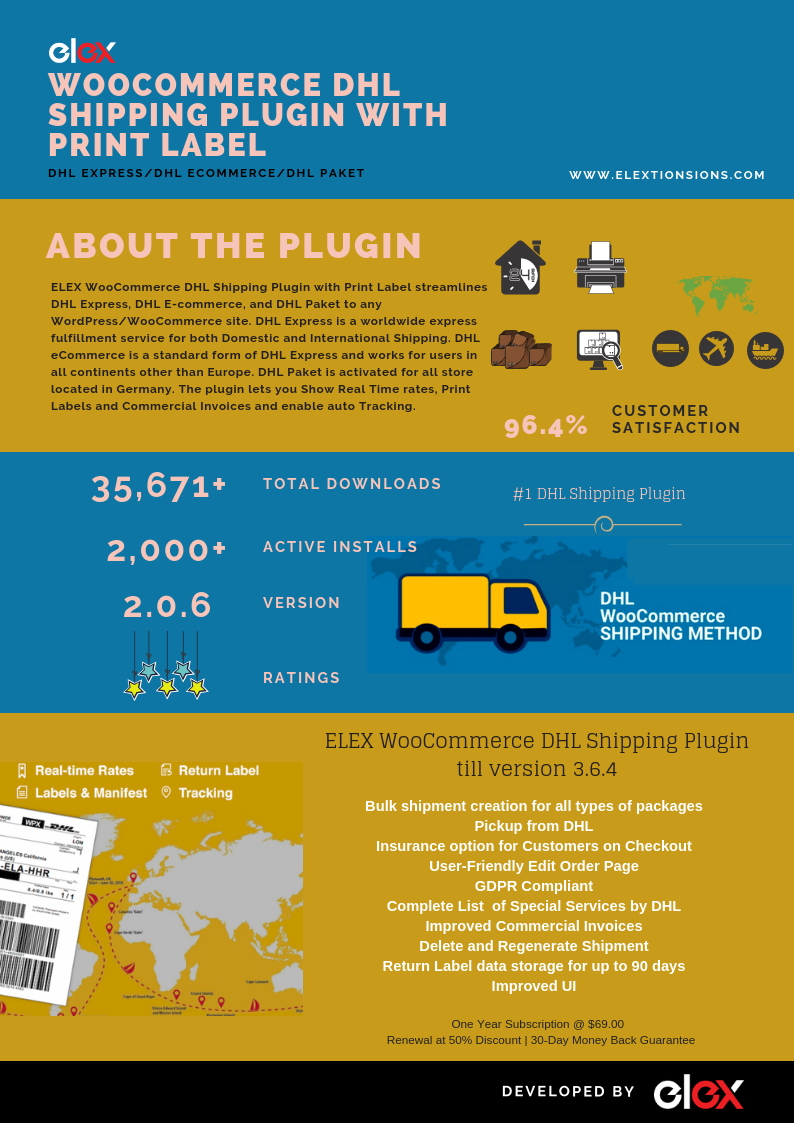

About the Plugin

ELEX WooCommerce DHL Shipping Plugin with Print Label

Bottom Line

When your packages are stuck at the customs, it means you need to put in additional effort to get them cleared. You may need to:

- Reprint correct labels & commercial invoices,

- Pay additional customs duties or

- Check if the packages are packed in the right way and contain only allowed items.

ELEX WooCommerce DHL Express Shipping Plugin helps you automate entire customs regulations from your admin panel itself. You can print shipping labels, commercial invoices and archive waybills for smooth deliveries across borders. Your DHL representative helps you to get your packages customs ready with their personal assistance. Finally, you should regularly check websites like USPS.com, DHL, UPS, FedEx, etc. for the latest notifications about changes in duties, documents required and the list of prohibited & restricted goods. All these steps will avoid any complications during the customs check.

Fill a basic form and ask your pre-sales question about any plugin at ELEX or simply leave a comment in the comment section. We’ll be happy to help.

Explore our blog section for more articles. You can also check out ELEX WooCommerce DHL Shipping Plugin with Print Label.

You can also check out WordPress and WooCommerce plugins in ELEX.